Automatically Spread Tax Returns & Financial Statements in Seconds!

Supercharge your spreading processes with Cync Spreading for streamlined financial analysis resulting in expedited approval processes and faster funding.

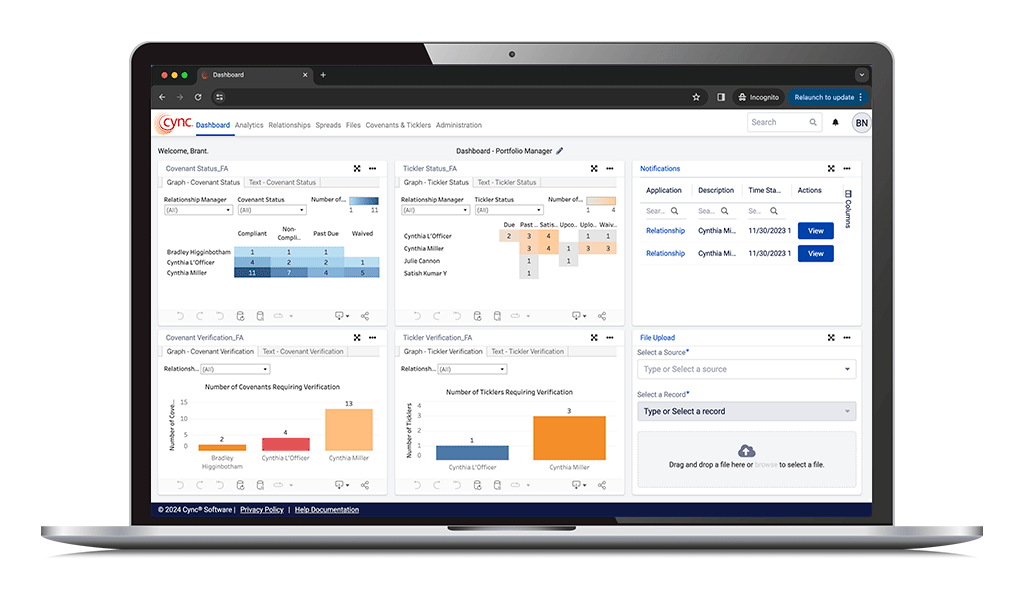

Create Custom Dashboards with Real-Time Analytics

Cync Spreading includes more than two dozen data visualizations and reports for real-time insights across your entire portfolio. Put your team first by customizing layouts by role and curating lists of reports to share to meet the needs of Credit Analysts, Portfolio Managers, and more!

Looking for user-centered reports? “My Analytics” provides comprehensive reports that are tied specifically to the user’s profile.

Cync Software also offers Reporting as a Service—a full-service option for custom reports to provide even the most granular insights for time and process optimization. Request a demo with our team to discuss what Cync Reporting as a Service can do for you!

No-Code Self-Service Administration Capabilities for Maximum Uptime

Empower your team and optimize your adoption rate with self-service administration capabilities, allowing flexible, codeless management of templates and core aspects of the application to get the team up and running in seconds. Request a demo to see for yourself!

-

Administrative Empowerment

Get the autonomy required for codeless template creation and administration that aligns with risk appetite, lending policies, and analytics.

-

Time Savings

Eliminate the need for manual intervention by allowing users to perform routine tasks, reducing the workload on administrators.

-

Cost Savings

Cut down on support costs and time spent on repetitive tasks with automation and APIs, allowing resources to work more strategically.

-

Consistent Reporting

Codeless management allows values to scale across microservices, making enhanced reporting both scalable and reliable.

Eliminate Downtime with Self-Service Management for Critical Processes in Financial Analysis

File Management

Create custom metadata fields, categories, and document types with best-in-class digital asset management for all lending services.

Spreading Management

Create codeless spreading templates in seconds with custom statement selections and field creation for Individual, C&I, and Real Estate spreads.

Covenant & Tickler Management

Self-service covenant and tickler creation has never been easier! Create standard covenants at the management level for accurate reporting and generate ticklers with your messaging, by your rules.

Profile Management

Easily customize user roles and permissions along with application-wide settings to enhance your security through role-based access controls (RBAC).

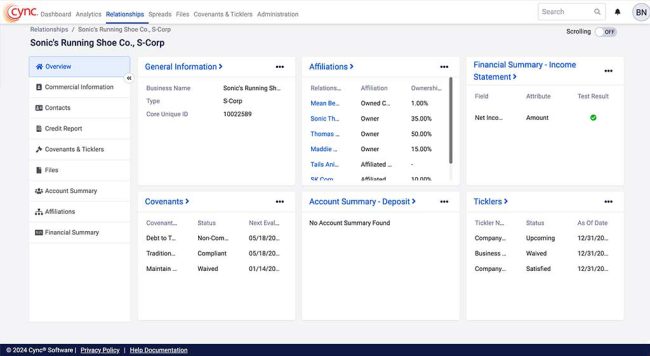

Meet Your Relationship Command Center

Get 360º insights you never thought possible with modules that offer comprehensive views and analysis based on affiliations—all with a secure file management system that integrates seamlessly with third parties and platform microservices. This is the command center for all relationship management.

Are you looking for new financial insights? Request a demo today to see what our Relationships module has to offer.

-

Launchpad for Any Task, Any Function

Request documents, credit scores, and more—all from one location

-

In-Depth Affiliations

Build a comprehensive network for relationship-driven insights

-

File & Document Management

Securely store documents for tracking, compliance, and accountability

-

Automated Spreading & Analysis

Create GAAP-compliant spreads with automation for analysis in seconds

-

Covenants & Ticklers Management

Take action and mitigate risk with time-saving automation and transparency

Automatically Spread Financials in Seconds

Import Financial Documents

Automatically Spread Financials

Analyze, Report, Decide

Ready to Supercharge Your Spreading Automation?

-

Commercial (C&I) Spreading

Spreading balance sheets and income statements from tax returns and financial statements has never been easier!

-

Real Estate Spreading

Automatically spread property cash flow and rent roll statements from tax returns and financial documents.

-

Individual Spreading

Automatically spread personal tax returns and respective schedules for a comprehensive view of financials.

Reduce Spreading Time by 80% with Real Insights & Analytics

Cync Spreading will automate your spreading process and see how your borrowers’ financials stack up against industry peers with our Risk Management Association (RMA) integration, and generate reports with informative data visualizations—all in a matter of seconds! Automated spreading capabilities are constantly being enhanced to take your financial reporting and analysis to the next level. Request a demo today to see what Cync Software can do for you.

Commercial Statements & Analysis

- Balance Sheet*

- Income Statement*

- Equity Reconciliation

- Debt Schedule

- UCA Cash Flow

- Direct Cash Flow

- Indirect Cash Flow

- Traditional Cash Flow

- Global Debt Service

- Stress Test

- Ratios

- Aggregated Periods

*Automated statement spreading available

Real Estate Statements & Analysis

- Property Cash Flow*

- Portfolio Analysis

- Rent Roll Analysis*

- Discounted Cash Flow

- Stress Test

- Debt Schedule

*Automated statement spreading available

Personal/Individual Statements & Analysis

- Personal Cash Flow*

- Personal Tax Return*

- Financial Statement

- Debt Schedule

- Global Debt Service

- Real Estate Schedule

*Automated statement spreading available

With Automated Covenants & Ticklers, Portfolio Monitoring Has Never Been Easier

Generate

Automate

Verify

Mitigate

Looking for a way to effortlessly monitor relationships with curated reports and engaging data visualizations?

Our Covenants & Ticklers feature allows lenders to create and monitor relationship-specific covenants and ticklers, automating the tracking process.

With automation, lenders simply need to verify the evaluation of a covenant, streamlining the process and helping to ensure accurate compliance reporting, internal reviews, and regulatory exams.

With a real-time connection to the customer portal, ongoing tickler document collection is both convenient and effective.

Request a demo today to expand your team’s risk mitigation capabilities.

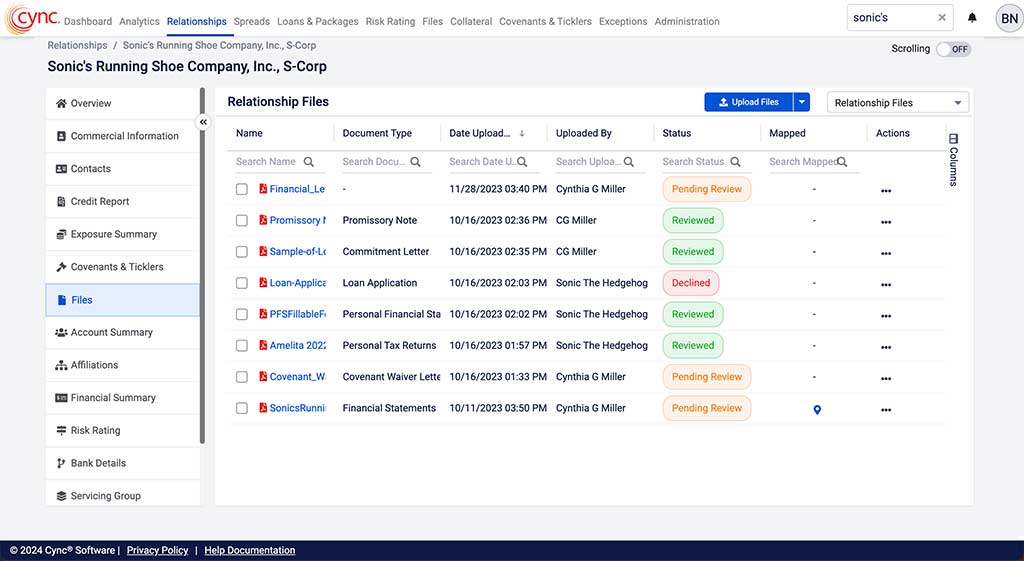

The Most Comprehensive File Management in Commercial Lending

Painless File Management

-

Customize Document Categories, Document Types, & Metadata

-

Upload Files Directly from the Dashboard

-

Track Approval Status, Activity, and More

-

Easily Search, Locate, and Preview Documents & Images

-

Confirm Mapped Financial Documents & Open Spreads

Your Portal for Document Request Optimization

Our secure, easy-to-use Cync Portal offers an inviting experience for all parties to experience transparent communication, provide documentation, and eSign documentation for fast and efficient approval.

Request a demo today to see what our portal can do for you.

-

Optimal Security in a Branded Environment

-

Transparent Communication with All Parties

-

eSign, Check Approval Status, Activities, and More

Cync Integrations Are Open for Business

Cync Software offers an integration framework that allows lenders to safely and securely hook into open APIs. Looking for a specific integration? Request a demo to see what our integrations team can do for you.